Life beyond COVID: fresh produce boost

The COVID pandemic has significantly impacted the way consumers are buying fresh produce, according to a case study delivered by data measurement firm Nielsen and funded by agricultural research and development corporation Hort Innovation. The “homebody economy” looks set to stay. Our “new normal” means many of us are working from home some or all of the time; we’re eating more food at home and eating out less often.

During the pandemic, there has been a surge in vegetable sales. There has also been an increase in the number of consumers – both here and around the world – who engage in online shopping, and a notable shift toward pre-packed produce options.

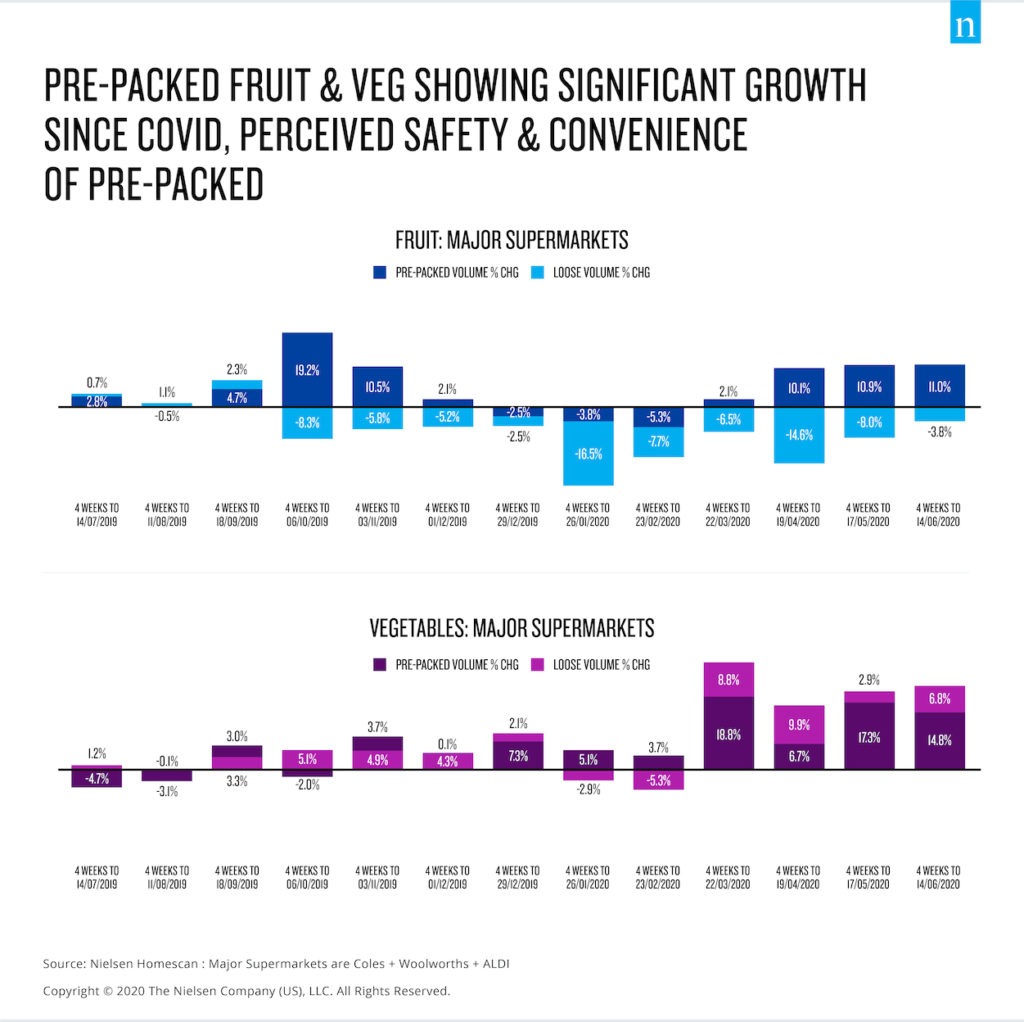

The move to pre-packed produce

A year ago, pre-packed fruit and vegetables made up 42 percent of the volume sold in major supermarkets. Post the onset of COVID, volume share has increased to 45 percent. This trend was more than likely driven by the need to limit time in the supermarket, food safety, convenience or a combination of all three, and is set to continue.

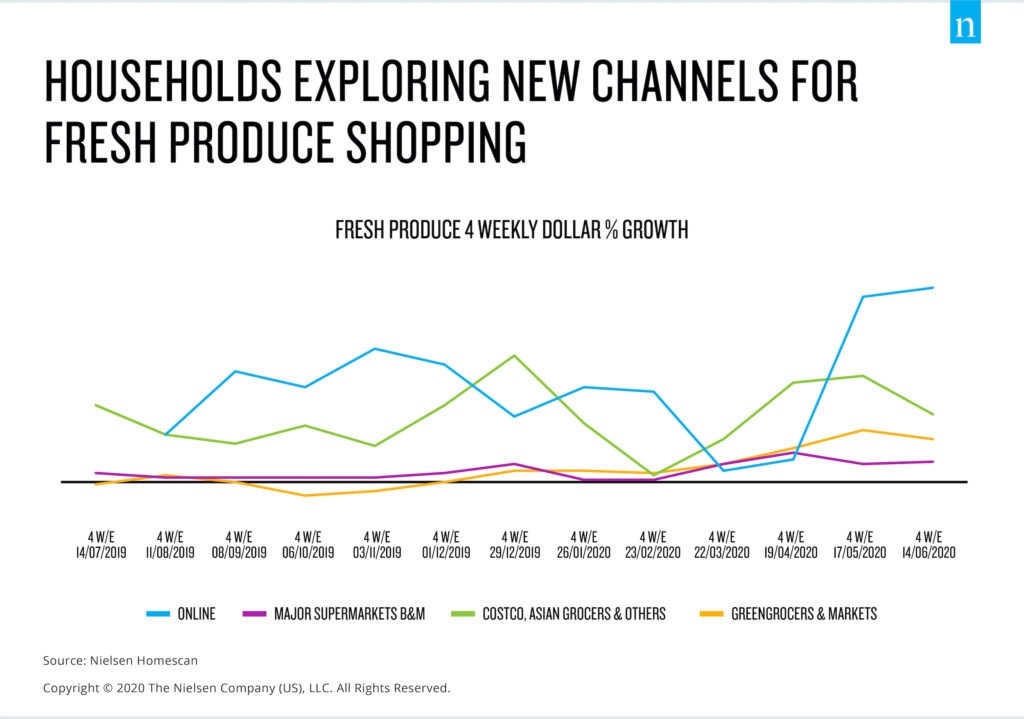

The rise of local

Since the start of COVID, many households have begun shopping in new channels. Driven initially by out-of-stocks and people working from home some or all of the time, households are now choosing to prioritise convenience for where they do their shopping.

Greengrocers and fresh food markets have picked up sales with the emergence of this trend, and shopping locally – from both a local product and a local retailer perspective – is a trend that’s being seen globally.

Over the past 12 weeks, greengrocers and markets have gained 1.2 share points of fresh produce. Meanwhile, other independent supermarkets grew 1.8 share points. In the UK, similar to Australia, 25 percent of shoppers are shopping at their closest store more often.

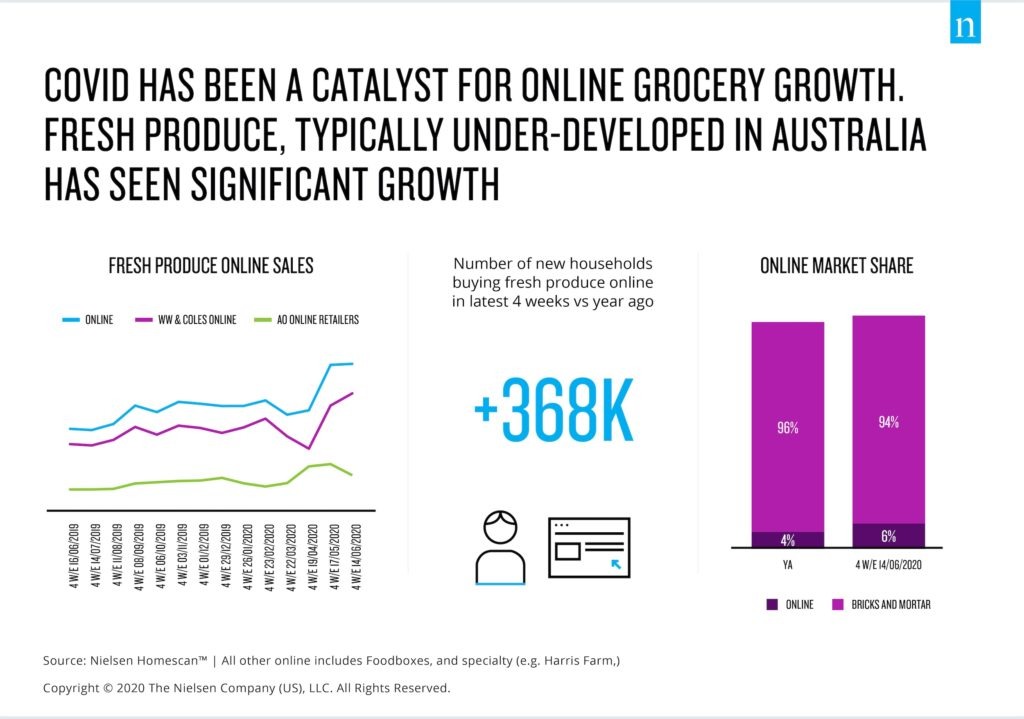

The rise of online fresh produce shopping

COVID has accelerated online adoption faster than what’s been recorded in recent years, with shoppers wanting to reduce contact with other shoppers. During the last 12 weeks, online represented eight percent of total grocery sales in Australia. This is up from five percent this time a year ago. Online represented six percent of fresh produce sales in Australia, up from four percent a year ago. The oldest and youngest demographic groups are leading the growth in online spending.

Consumer behaviour must be repeated to become habitual. During the past 12 weeks, nearly two-thirds of households were repeat purchasers of fresh produce online. It suggests that this has become their new normal. Sales data from other countries such as the US and China show that this channel continues to grow as the pandemic progresses.

In Australia, Woolworths and Coles represent nearly three-quarters of online fresh produce sales; however, these retailers struggled to meet demand during March and April. So smaller online outlets such as fruit and veg box providers and specialty stores gained some share.

So what does the future hold for fresh produce sales in the new normal environment? Overall, the ongoing domestic demand for food and fresh produce will remain. According to the Global Consumer Confidence survey, right now, health is the number two concern after the economy. Fresh produce is uniquely placed, resonating with shoppers prioritising health and value for money. All fruit and vegies have health and immune system-boosting qualities at a significantly cheaper price than supplements.